How Your Rental Counter Can Save Time with Integrated Credit Card Processing

When a customer calls – or comes in – to start a new rental, how does your counter staff process the customer’s payment?

If they have to start the rental contract in your ERP, then go to a separate application to enter the customer’s credit card information, then go back to your rental software to finish up the reservation, those extra steps make the process more complicated than it needs to be. (They also mean more room for error, entering information multiple times in multiple systems.)

If the customer doesn’t have their card handy – or if you write the card number on a notepad to deal with later in the day – that’s even more time spent on each transaction. Multiply that by every single rental, every single day, and you’re looking at hours of time lost to a manual process.

Faster Transactions Within the Rental Software You Already Use

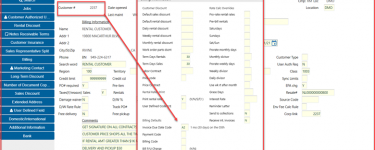

With integrated credit and debit card processing, you cut out the extra steps. Your counter staff can charge a customer’s card on file (or add a brand new payment method) without leaving the screen they’re already on. They create the contract, then process the transaction on the same screen.

Authorizations come back in real time. You typically get your response within two seconds. Once the payment has been processed, you can continue on with the reservation – whether that’s sending a payment confirmation to the customer or sending the yard a notification to stage the machine for delivery.

Save Even More Time with Automated Daily Settlements

It’s not just your counter staff that can save time with integrated payments; your accounting team can streamline their manual processes as well.

Instead of manually batching and transmitting your transactions every night, you can have an automated job scheduler send your settlements to your acquirer. You don’t have to flag each individual transaction to be included in your daily settlement batch, or pay higher processing fees if you don’t settle on the same day. Everything is streamlined in the background, and your accounting team gets to focus on the rest of their work.