Cash Basis vs. Accrual Basis: Which Accounting Method is Right For Your Rental Business?

When it comes to accounting, rental businesses can choose between two different methods: cash basis and accrual basis.

Cash Basis Accounting

Cash basis accounting shows transactions on a company’s financial statements at the time the cash flows into (or out of) the business.

Accrual Basis Accounting

Accrual basis accounting reflects these transactions as they occur – even if payment is not made or received until a later date.

An A/R Example:

A customer signs a $1,700 contract to rent a skid steer from January 20 to February 5. No deposit is taken; payment is due in full on return of the machine.

Under accrual basis accounting, the $1,700 in revenue would be recognized on January 20 (when it is earned). On an accrual basis, the revenue would be recognized on February 5 (when it is collected).

An A/P Example:

You sign a purchase order for a $50,000 boom lift on July 1. The manufacturer has a 35-week lead time; payment is due when the machine is delivered in March of the following year.

Under accrual basis accounting, the expenditure would be recognized on July 1. Under cash basis, it would be recognized the following March, when your Accounts Payable team cuts the check.

The Benefits of Accrual Basis Accounting

While cash basis accounting tends to be easier – especially for smaller and newer rental businesses – accrual basis provides a more complete picture of your finances as you grow. You get a more accurate view of upcoming and past-due payments than you would with a cash-based approach. This, in turn, provides more accurate forecasting.

Accrual basis can also help you avoid the pitfall of carrying a high A/P balance that exceeds your current revenue stream. In such a situation, your business may look profitable, but is actually losing money – a crucial mistake to avoid when it comes to long-term financial health.

Your future plans for your business also come into play. Investors and auditors typically require companies to comply with Generally Accepted Accounting Principles (GAAP); cash accounting is not considered GAAP-compliant. If you’re looking to obtain third-party funding or sell your rental business to a publicly traded company, you may be required to switch to accrual-based methods.

Accrual-Based Accounting Solutions for Your Rental Business

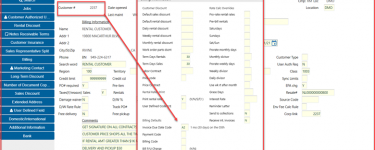

To help with the increased complexity of accrual-based accounting, many growing rental businesses use software packages to help with earned-not-billed accruals, AR aging reports, GL batches, bank reconciliations, and other related tasks.

At InTempo, our software is specifically designed to meet the needs of accrual-based rental organizations. Our robust accounting module gives you everything you need to simplify Accounts Payable, Accounts Receivable, General Ledger, bank reconciliations, month- and year-end close, and other essential tasks.

If you’re looking to improve your approach to financial management, take a more in-depth look at InTempo’s accounting features, or let us know: how can we help you grow your rental business?