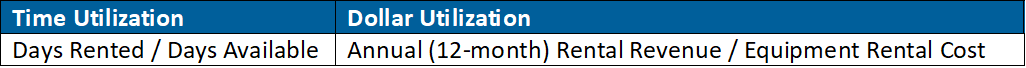

Which Equipment Rental Metric is More Important: Time Utilization or Dollar Utilization?

Time utilization and dollar (financial) utilization are both crucial equipment rental metrics. Both give an important look at the demand for – and the return you’re collecting on – individual machines from your fleet.

Many companies track both. But, at the end of the day: which one is more important?

Even though there are many different utilization metrics that can be viewed and analyzed within an equipment rental organization, these two are definitely at the top of the list. I often get asked which one is more important. On the surface, this is an easy question, since you can’t take time to the bank.

But the realistic answer is: you can't have one without the other. If you understand what both data points are telling you, these two indicators can become an anchor point in managing your fleet and financial position.

What Equipment Rental Companies Need to Know About Dollar Utilization

This metric is a critical way to assess your pricing.

Dollar utilization targets tend to vary based on the type of rental business you are operating and the makeup of your fleet by original unit cost. (For instance: there can be a big swing between a general rental business and one that specializes in heavy earth moving equipment, and between companies who negotiate heavily with their manufacturers than those who pay higher prices to acquire new rental assets. The higher the cost at the unit level, the lower total dollar utilization you might expect.)

To keep everyone on the same (reasonable) page, you should determine your target metric at the time you acquire a new asset group, taking into account your stakeholders’ expectations. From there, you can aggregate all your rented asset groups into a targeted dollar utilization number, as well as a lifetime ROI for your company.

How to Calculate Dollar Utilization

As a financial utilization formula, divide your annual (12-month) rental revenue by the equipment rental cost.

As an example: if your fleet unit costs $500,000 and it earns you $250,000 in revenue, your dollar utilization is 50 percent.

Dollar Utilization Targets

Your target will depend heavily on your fleet mix.

For many national equipment rental chains, a 55 to 65 percent rate is considered acceptable. (Independent companies may set slightly lower average targets.) On the party side, however, rates of 150 percent or higher are not abnormal. Comparing your crane rental company to a wedding rental company wouldn’t give you an apples-to-apples comparison; you’ll need to assess your company’s unique fleet mix to get accurate insights.

What Equipment Rental Companies Need to Know About Time Utilization

Time utilization indicates how frequently your assets are rented out. This metric can help you understand if you have too few – or too many – of a particular category/class in your yard.

How to Calculate Time Utilization

For example: if you rent an asset group by the day and have a fleet of 100 machines within that group, your total is 36,500 rentable days per year (based on a seven-available-day model.) If that asset group is on rent for a total of 25,000 of those days, your time utilization for that group is 68.5 percent.

Time Utilization Targets

Like dollar utilization, your time utilization target needs to be determined up front when you acquire a new asset group. Again, consider stakeholder expectations, the lifetime ROI, and the life expectancy of the equipment in question. The key is to find a “happy point” based on your fleet mix.

For most general rental companies, a 65 percent time utilization target is a solid expectation. However, when it comes to time utilization, it’s important to note that – unlike dollar utilization – higher is not always better. Certain asset groups can go higher than 65 percent, but when companies start exceeding this, they may begin to wear their fleet out prematurely.

There are lots of factors that can impact this; customer base and fleet mix being the main ones. If you are exceeding your dollar utilization target by more than 25 percent, you may be able to tolerate a higher time utilization as you will achieve your desired ROI more quickly. On the other hand, if you are just barely achieving your targeted dollar utilization and your time utilization is 25 percent higher than your baseline, you’re unlikely to meet your ROI goals before you wear the asset out.

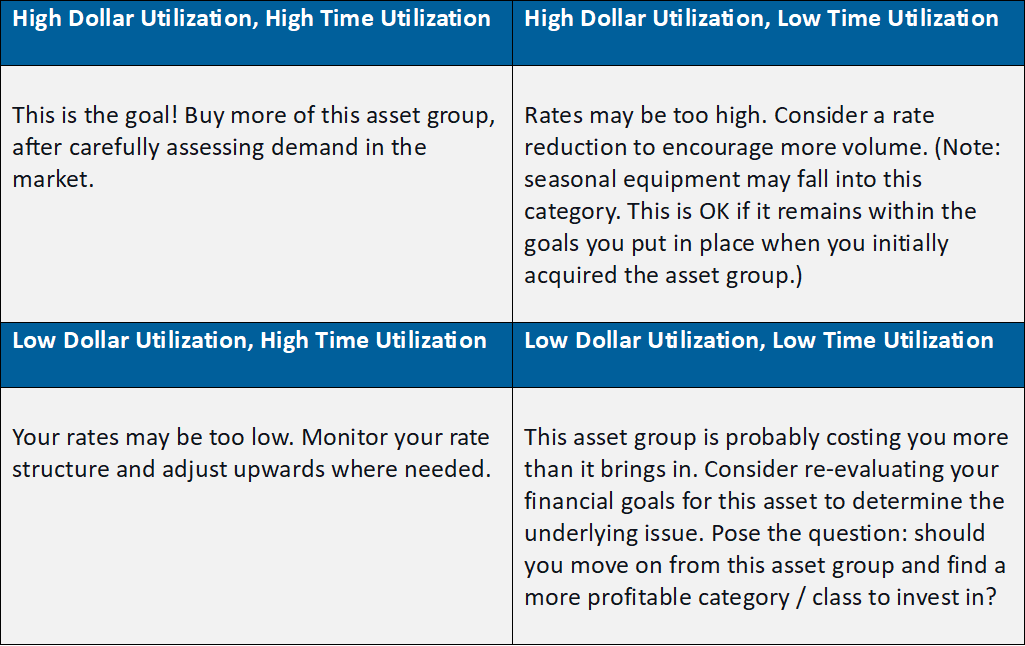

How Equipment Rental Companies Should Balance Time and Dollar Utilization

Let’s look at some of the potential time and dollar utilization combinations.

So: how do these insights help you make meaningful improvements to your rental business?

- Take the guesswork out of fleet management

- Use data – not a “gut feeling” – to identify the right time to purchase new rental assets

- Know when to dispose of underperforming (low-utilization) assets, then use the funds to re-invest in your top-performing (high-utilization) equipment

- More proactively manage your rental rates to optimize revenue and profits

Ultimately, I encourage companies to focus on maximizing their dollar utilization – not their time utilization. However, the two are inextricably joined. Dollar utilization depends on rental revenue, which is driven by time utilization, and influenced by rental rates and reasonable ROI expectations.

What Makes Your Business Successful?

As you develop metrics for your own rental business, comparing your business model to the industry standard is always essential. However, I always encourage companies to take a deeper look inside their own organization. Time and dollar utilization alone are not sufficient for effective fleet management; other goals will come into play in regard to making your rental business truly successful. However, they’re a great first step in detecting when – and where – you need to dig a little deeper and make better business decisions.

Track Your Most Important Equipment Rental Metrics with InTempo

At InTempo, we’ve built a comprehensive suite of rental software solutions that will help you improve your approach to fleet management. Our tools are designed to help local, independent companies level the playing field with large, national companies that have substantial analytics departments and fleet management teams; InTempo’s technologies help you make the most of the resources you have right now.

InTempo Reporter makes it easy to track your most important metrics. Pulling real-time data directly from your rental ERP, it lets you move away from manual spreadsheets and hand-calculated results. You can measure any utilization or profitability metric you could possibly need – be it for a single machine, a single store, or across your entire organization. More importantly, visual dashboards help you convert your business data into meaningful insights that will help you make smarter operational decisions and improve your bottom line.

InTempo MX, our Connected Asset Solution, also delivers additional opportunities for more in-depth monitoring and analysis.

For example, you can go beyond your own utilization rates and assess your customers’ equipment usage. With real-time telematics, you can compare how much a customer is running a rental asset to the time allowed by their contact agreement.

If you rent out an asset for a month with 160 hours of contracted run time, you’ll have some customers who run it for 180 hours and others than only run it for 80. A connected assets solution can help you make more informed decisions about customer-specific rates and discounts.

Interested in learning more about your options? Contact us today to start building a stronger, more insightful rental analytics program.

Written by Tony Tye

Tony is the Product Manager for InTempo MX and Reporter 5. With experience in several critical areas – from leading operations at a multi-location rental organization to managing the service team at several heavy equipment shops – he is now working one-on-one with customers to develop the next generation of rental software.